Get Pre-Approved Now

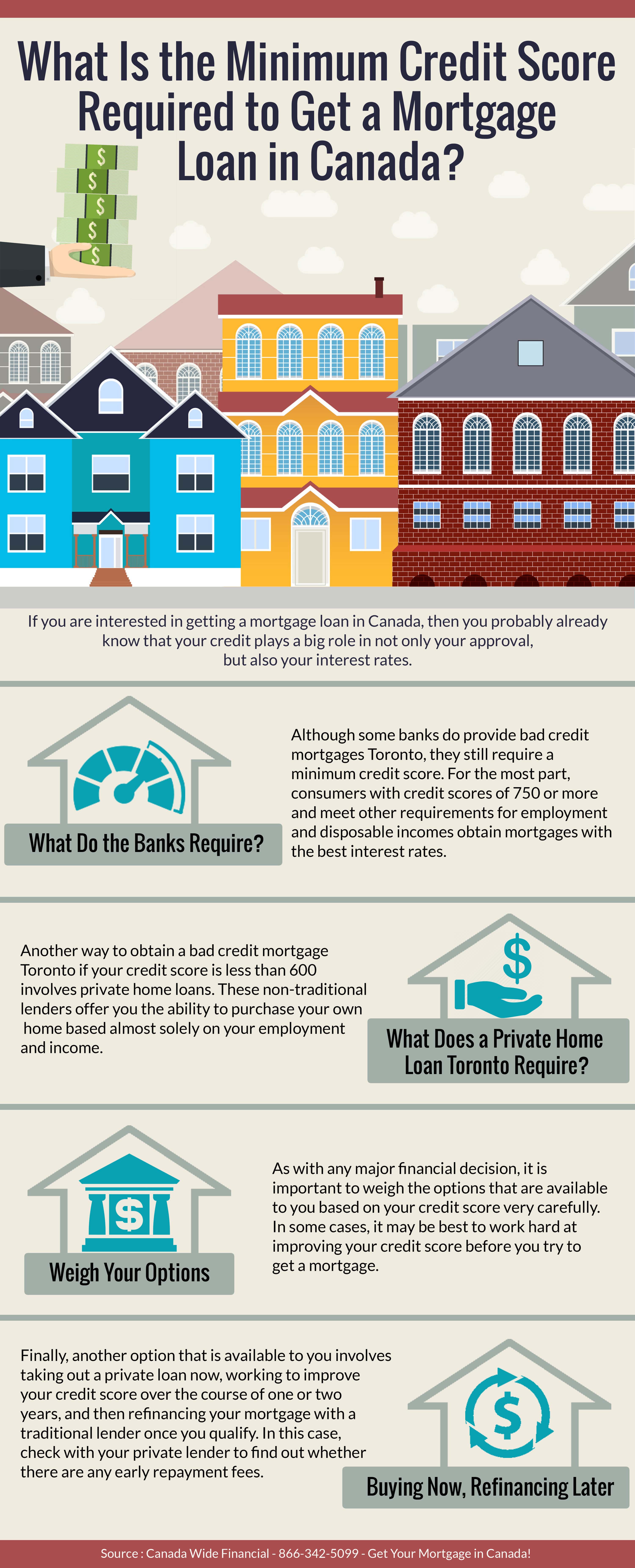

What Is the Minimum Credit Score Required to Get a Mortgage Loan in Canada?

Use the Code Below to Embed this Infographic into Your Website!

If you are interested in getting a mortgage loan in Canada, then you probably already know that your credit plays a big role in not only your approval, but also your interest rates. Although there is no minimum credit score requirement to obtain private home loans, most of the banks and lenders that provide the lower interest rates do have credit requirements.

What Do the Banks Require?

Although some banks do provide bad credit mortgages Toronto, they still require a minimum credit score. For the most part, consumers with credit scores of 750 or more and meet other requirements for employment and disposable incomes obtain mortgages with the best interest rates. Most financial experts agree that the cutoff point for receiving a traditional mortgage in Canada is 600, though some exceptions do apply. For instance, if your credit score is just below the 600 mark but your employment history is solid and your income is more than enough to cover the mortgage payments, a bank might consider your application.

What Does a Private Home Loan Toronto Require?

Another way to obtain a bad credit mortgage Toronto if your credit score is less than 600 involves private home loans. These non-traditional lenders offer you the ability to purchase your own home based almost solely on your employment and income. However, while there is no minimum credit score requirement for this type of loan, bear in mind that you will need a down payment of between 15% and 20% of the final value of the loan. Whats more, the interest rates associated with private loans are quite high at between 7% and 18%, depending on your unique situation and the lenders terms.

Weigh Your Options

As with any major financial decision, it is important to weigh the options that are available to you based on your credit score very carefully. In some cases, it may be best to work hard at improving your credit score before you try to get a mortgage. This way, you can reduce your overall debt, which makes it easier to make your monthly mortgage payments on time. Conversely, if renting is difficult for you and buying a house would be the cheaper option – even with the higher interest rates – then seeking a private lender might be the best choice.

Buying Now, Refinancing Later

Finally, another option that is available to you involves taking out a private loan now, working to improve your credit score over the course of one or two years, and then refinancing your mortgage with a traditional lender once you qualify. In this case, check with your private lender to find out whether there are any early repayment fees. Sometimes, you may pay a penalty for paying off the balance of your mortgage too early. This fee may be a fixed amount for the first 12 to 36 months after you obtain your loan, or the lender may scale the fee based on the length of time since you obtained the loan.

There are several ways to get a bad credit mortgage Toronto, and you might qualify for a traditional mortgage if your credit score is 600 or higher. However, if you do not yet meet this requirement, there are plenty of ways to get private home loans, too.