Get Pre-Approved Now

Is There a Better Time Than Now to Purchase a Home in the GTA? (Even With Bad Credit!)

Use the Code Below to Embed this Infographic into Your Website!

Without a doubt, there are times when it makes sense to purchase a home and other times when it makes sense to wait. For anyone who is thinking about buying a home in the Greater Toronto Area, now is the time to look into financing options. This is true even for people who don’t have the best credit. Here are some things you need to know about the housing marketing the GTA and why the current state makes it such a great time to buy.

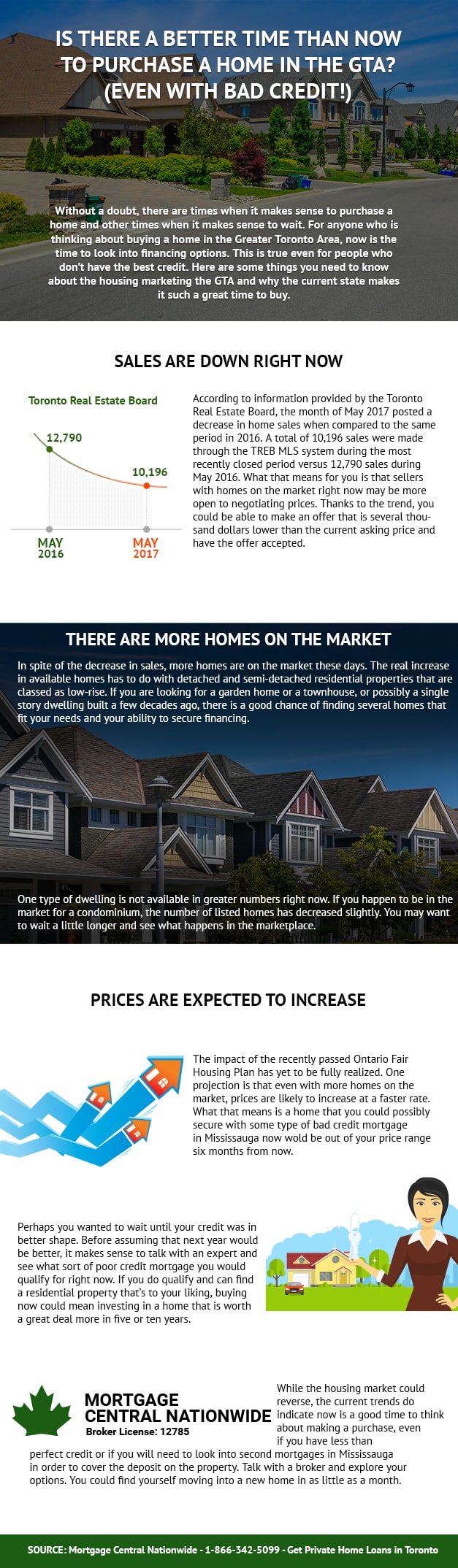

Sales are Down Right Now

According to information provided by the Toronto Real Estate Board, the month of May 2017 posted a decrease in home sales when compared to the same period in 2016. A total of 10,196 sales were made through the TREB MLS system during the most recently closed period versus 12,790 sales during May 2016. What that means for you is that sellers with homes on the market right now may be more open to negotiating prices. Thanks to the trend, you could be able to make an offer that is several thousand dollars lower than the current asking price and have the offer accepted.

There are More Homes on the Market

In spite of the decrease in sales, more homes are on the market these days. The real increase in available homes has to do with detached and semi-detached residential properties that are classed as low-rise. If you are looking for a garden home or a townhouse, or possibly a single story dwelling built a few decades ago, there is a good chance of finding several homes that fit your needs and your ability to secure financing.

One type of dwelling is not available in greater numbers right now. If you happen to be in the market for a condominium, the number of listed homes has decreased slightly. You may want to wait a little longer and see what happens in the marketplace.

Prices are Expected to Increase

The impact of the recently passed Ontario Fair Housing Plan has yet to be fully realized. One projection is that even with more homes on the market, prices are likely to increase at a faster rate. What that means is a home that you could possibly secure with some type of bad credit mortgage in Mississauga now would be out of your price range six months from now.

Perhaps you wanted to wait until your credit was in better shape. Before assuming that next year would be better, it makes sense to talk with an expert and see what sort of poor credit mortgage you would qualify for right now. If you do qualify and can find a residential property that’s to your liking, buying now could mean investing in a home that is worth a great deal more in five or ten years.

While the housing market could reverse, the current trends do indicate now is a good time to think about making a purchase, even if you have less than perfect credit or if you will need to look into second mortgages in Mississauga in order to cover the deposit on the property. Talk with a broker and explore your options. You could find yourself moving into a new home in as little as a month.