Get Pre-Approved Now

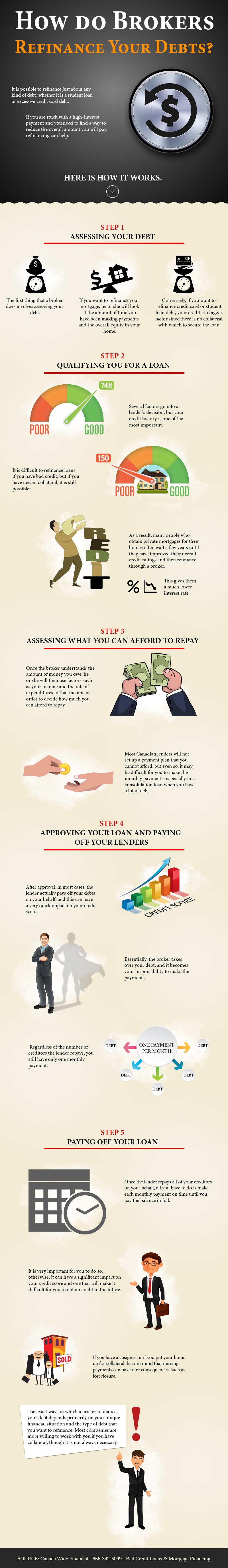

How do Brokers Refinance Your Debts?

Although the term "refinance" is often associated with mortgages, it is possible to refinance just about any kind of debt, whether it is a student loan or excessive credit card debt. As such, if you are stuck with a high-interest payment and you need to find a way to reduce the overall amount you will pay, refinancing can help. Here is how it works.

Use the Code Below to Embed this Infographic into Your Website!

Step 1 – Assessing Your Debt

The first thing that a broker does involves assessing your debt. If you want to refinance your mortgage, he or she will look at the amount of time you have been making payments and the overall equity in your home. Conversely, if you want to refinance credit card or student loan debt, your credit score is a bigger factor since there is no collateral with which to secure the loan.

Step 2 – Qualifying You for a Loan

Several factors go into a lenders decision, but your credit history is one of the most important. It is difficult to refinance loans if you have bad credit, but if you have decent collateral, it is still possible. As a result, many people who obtain private mortgages for their homes often wait a few years until they have improved their overall credit ratings and then refinance through a broker. This gives them a much lower interest rate.

Step 3 – Assessing What You Can Afford to Repay

Once the broker understands the amount of money you owe, he or she will then use factors such as your income and the rate of expenditures to that income in order to decide how much you can afford to repay. Most Canadian lenders will not set up a payment plan that you cannot afford, but even so, it may be difficult for you to make the monthly payment – especially in a consolidation loan when you have a lot of debt.

Step 4 – Approving Your Loan and Paying Off Your Lenders

After approval, in most cases, the lender actually pays off your debts on your behalf, and this can have a very quick impact on your credit score. Essentially, the broker takes over your debt, and it becomes your responsibility to make the payments. This is true whether you refinance your home or several credit card debts. Regardless of the number of creditors the lender repays, you still have only one monthly payment.

Step 5 – Paying Off Your Loan

Once the lender repays all of your creditors on your behalf, all you have to do is make each monthly payment on time until you pay the balance in full. It is very important for you to do so; otherwise, it can have a significant impact on your credit score and one that will make it difficult for you to obtain credit in the future. If you have a cosigner or if you put your home up for collateral, bear in mind that missing payments can have dire consequences, such as foreclosure.

The exact ways in which a broker refinances your debt depends primarily on your unique financial situation and the type of debt that you want to refinance. Most companies are more willing to work with you if you have collateral, though it is not always necessary.