Get Pre-Approved Now

Tips to Save and Earn for a Down Payment

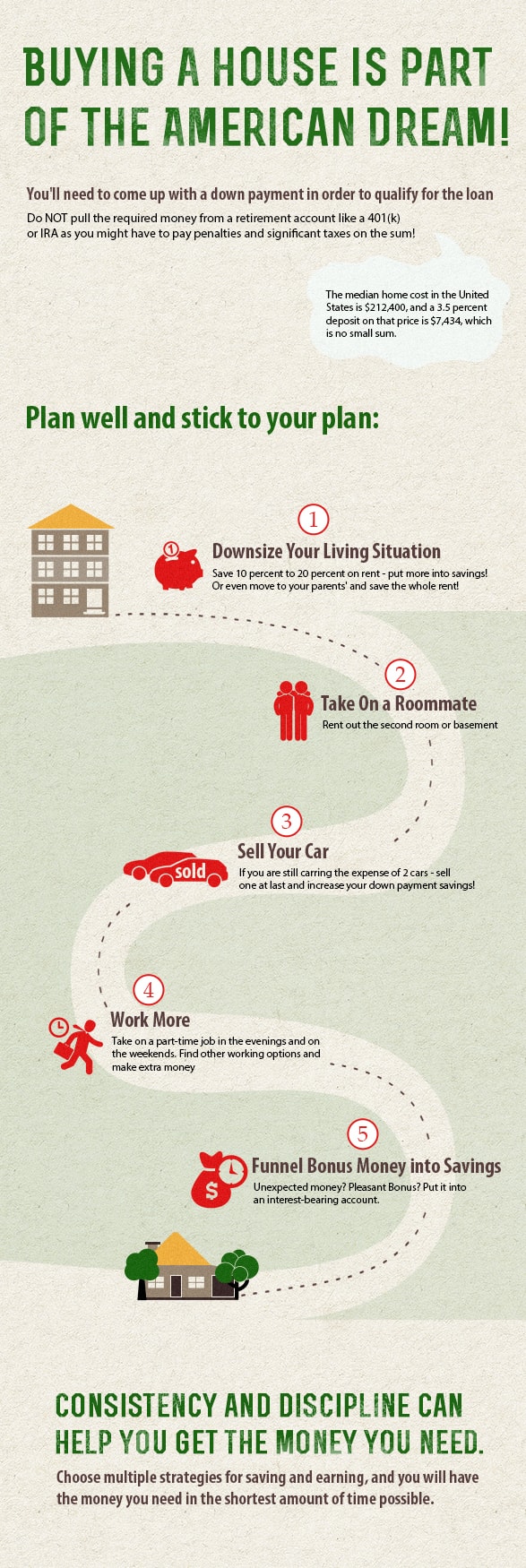

Are you dreaming of buying your very own house, but dont know how to save money for a down payment? Dont let these expenses deter you from your dream! Check the infographic to find effective saving and earning strategies that can help you come up with the required amount of money quickly.

Use the Code Below to Embed this Infographic into Your Website!

How to Quickly Save and Earn for a Down Payment

Buying a house is part of the American Dream. You own a little piece of property to build your personal wealth, and you have a place to raise your family. If youre lucky, your home can grow significantly in value over the years, and you can leave a valuable estate to your children, who can then leave it to their children, and so on.

Before you can buy the home of your dreams, youll need to come up with a down payment in order to qualify for the loan. The bigger the down payment, the better the loan terms you can get, including a lower interest rate and freedom from purchasing private mortgage insurance, which can cost 0.3 percent to 1.5 percent the value of the mortgage.

Some loans require a specific down payment. For example, the Federal Housing Administration provides loans for first-time home buyers that require a down payment of 3.5 percent. The median home cost in the United States is $212,400, and a 3.5 percent deposit on that price is $7,434, which is no small sum. FHA loans also require borrowers to carry private mortgage insurance, which can add hundreds of dollars to the monthly payment.

Traditionally, lenders have asked for a 20 percent deposit for the best loan terms, which is $42,480 for that same median price. You may feel tempted to pull that money from a retirement account like a 401(k) or IRA, but you might have to pay penalties and significant taxes on the sum. Youll also be taking money out of needed retirement accounts, and you will ultimately have to pay it back (unless you want to pay even more penalties).

Coming up with such a large sum on your own may be daunting, but it can be done if you plan well and stick to your plan. Here are a few things you can do to quickly save and earn for a down payment for your dream home:

Downsize Your Living Situation

If you currently live in a two-bedroom apartment, move into a one-bedroom apartment. You could save 10 percent to 20 percent on rent, which could be a few hundred dollars per month, depending on where you live. Say your rent drops from $800 a month to $500 a month, you could be putting $300 per month into savings.

If you are able to, moving back in with your parents could help you save the entire $800 a month to put toward your down payment. Youll just have to have parents who will let you live rent-free for that time -- and youll also have to have the patience to live with your parents again.

Take On a Roommate

You dont have to move into a smaller space to cut your rent. Just take on a roommate. Rent out that second room and save the money you get for your down payment. If you rent a home, consider renting out a spare room or a basement apartment.