Get Pre-Approved Now

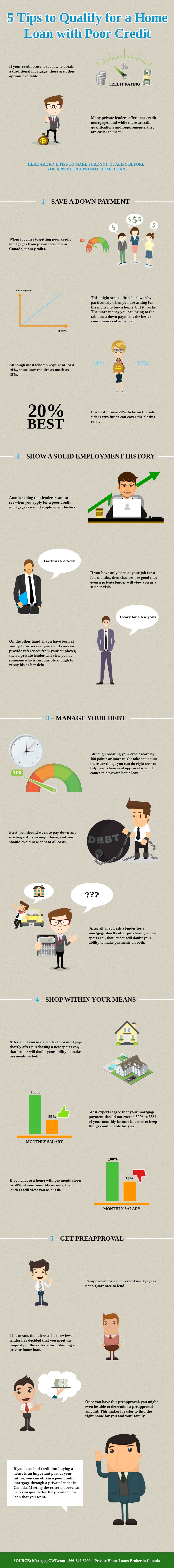

5 Tips to Qualify for a Home Loan with Poor Credit

Use the Code Below to Embed this Infographic into Your Website!

If your credit score is too low to obtain a traditional mortgage, there are other options available. Many private lenders offer poor credit mortgages, and while there are still qualifications and requirements, they are easier to meet. Here are five tips to make sure you qualify before you apply for a private home loan.

#1 – Save a Down Payment

When it comes to getting poor credit mortgages from private lenders in Canada, money talks. This might seem a little backwards, particularly when you are asking for the money to buy a home, but it works. The more money you can bring to the table as a down payment, the better your chances of approval. Although most lenders require at least 10%, some may require as much as 15%. It is best to save 20% to be on the safe side; extra funds can cover the closing costs.

#2 – Show a Solid Employment History

Another thing that lenders want to see when you apply for a poor credit mortgage is a solid employment history. If you have only been at your job for a few months, then chances are good that even a private lender will view you as a serious risk. On the other hand, if you have been at your job for several years and you can provide references from your employer, then a private lender will view you as someone who is responsible enough to repay his or her debt.

#3 – Manage Your Debt

Although boosting your credit score by 100 points or more might take some time, there are things you can do right now to help your chances of approval when it comes to a private home loan. First, you should work to pay down any existing debt you might have, and you should avoid new debt at all costs. After all, if you ask a lender for a mortgage shortly after purchasing a new sports car, that lender will doubt your ability to make payments on both.

#4 – Shop within Your Means

Another thing that turns even private lenders off to the idea of providing you with poor credit loans Toronto involves choosing homes that cost far more than what you can really afford. Most experts agree that your mortgage payment should not exceed 30% to 35% of your monthly income in order to keep things comfortable for you. If you choose a home with payments closer to 50% of your monthly income, then lenders will view you as a risk.

#5 – Get Preapproval

Preapproval for a poor credit mortgage is not a guarantee to lend. This means that after a short review, a lender has decided that you meet the majority of the criteria for obtaining a private home loan. Once you have this preapproval, you might even be able to determine a preapproval amount. This makes it easier to find the right home for you and your family.

If you have bad credit but buying a house is an important part of your future, you can obtain a poor credit mortgage through a private lender in Canada. Meeting the criteria above can help you qualify for the private home loan that you want.