Get Pre-Approved Now

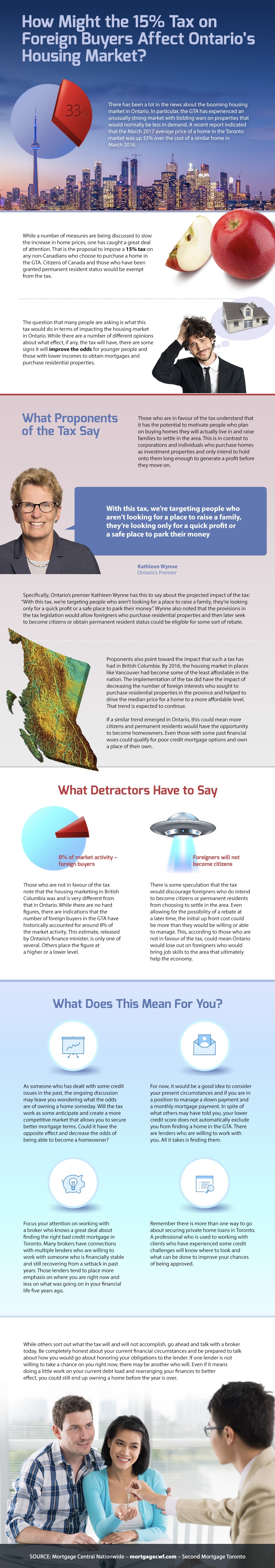

How Might the 15% Tax on Foreign Buyers Affect Ontario’s Housing Market?

Use the Code Below to Embed this Infographic into Your Website!

There has been a lot in the news about the booming housing market in Ontario. In particular, the GTA has experienced an unusually strong market with bidding wars on properties that would normally be less in demand. A recent report indicated that the March 2017 average price of a home in the Toronto market was up 33% over the cost of a similar home in March 2016.

While a number of measures are being discussed to slow the increase in home prices, one has caught a great deal of attention. That is the proposal to impose a 15% tax on any non-Canadians who choose to purchase a home in the GTA. Citizens of Canada and those who have been granted permanent resident status would be exempt from the tax.

The question that many people are asking is what this tax would do in terms of impacting the housing market in Ontario. While there are a number of different opinions about what effect, if any, the tax will have, there are some signs it will improve the odds for younger people and those with lower incomes to obtain mortgages and purchase residential properties.

What Proponents of the Tax Say?

Those who are in favour of the tax understand that it has the potential to motivate people who plan on buying homes they will actually live in and raise families to settle in the area. This is in contrast to corporations and individuals who purchase homes as investment properties and only intend to hold onto them long enough to generate a profit before they move on.

Specifically, Ontario’s premier Kathleen Wynne has this to say about the projected impact of the tax: “With this tax, we’re targeting people who aren’t looking for a place to raise a family, they’re looking only for a quick profit or a safe place to park their money.” Wynne also noted that the provisions in the tax legislation would allow foreigners who purchase residential properties and then later seek to become citizens or obtain permanent resident status could be eligible for some sort of rebate.

Proponents also point toward the impact that such a tax has had in British Columbia. By 2016, the housing market in places like Vancouver had become some of the least affordable in the nation. The implementation of the tax did have the impact of decreasing the number of foreign interests who sought to purchase residential properties in the province and helped to drive the median price for a home to a more affordable level. That trend is expected to continue.

The similar trend emerged in Kitchener, this means more citizens and permanent residents would have the opportunity to become homeowners. Even those with some past financial woes could qualify for poor credit mortgages Kitchener options and own a place of their own.

What Detractors Have to Say

Those who are not in favour of the tax note that the housing marketing in British Columbia was and is very different from that in Ontario. While there are no hard figures, there are indications that the number of foreign buyers in the GTA have historically accounted for around 8% of the market activity. This estimate, released by Ontario’s finance minister, is only one of several. Others place the figure at a higher or a lower level.

There is some speculation that the tax would discourage foreigners who do intend to become citizens or permanent residents from choosing to settle in the area. Even allowing for the possibility of a rebate at a later time, the initial up front cost could be more than they would be willing or able to manage. This, according to those who are not in favour of the tax, could mean Ontario would lose out on foreigners who would bring job skills to the area that ultimately help the economy.

What Does This Mean For You?

As someone who has dealt with some credit issues in the past, the ongoing discussion may leave you wondering what the odds are of owning a home someday. Will the tax work as some anticipate and create a more competitive market that allows you to secure better mortgage terms. Could it have the opposite effect and decrease the odds of being able to become a homeowner?

For now, it would be a good idea to consider your present circumstances and if you are in a position to manage a down payment and a monthly mortgage payment. In spite of what others may have told you, your lower credit score does not automatically exclude you from finding a home in the GTA. There are lenders who are willing to work with you. All it takes is finding them.

ocus your attention on working with a broker who knows a great deal about finding the right bad credit mortgage Ottawa. Many brokers have connections with multiple lenders who are willing to work with someone who is financially stable and still recovering from a setback in past years. Those lenders tend to place more emphasis on where you are right now and less on what was going on in your financial life five years ago.

Remember there is more than one way to go about securing private home loans in Toronto. A professional who is used to working with clients who have experienced some credit challenges will know where to look and what can be done to improve your chances of being approved.

While others sort out what the tax will and will not accomplish, go ahead and talk with a broker today. Be completely honest about your current financial circumstances and be prepared to talk about how you would go about honoring your obligations to the lender. If one lender is not willing to take a chance on you right now, there may be another who will. Even if it means doing a little work on your current debt load and rearranging your finances to better effect, you could still end up owning a home before the year is over.