Get Pre-Approved Now

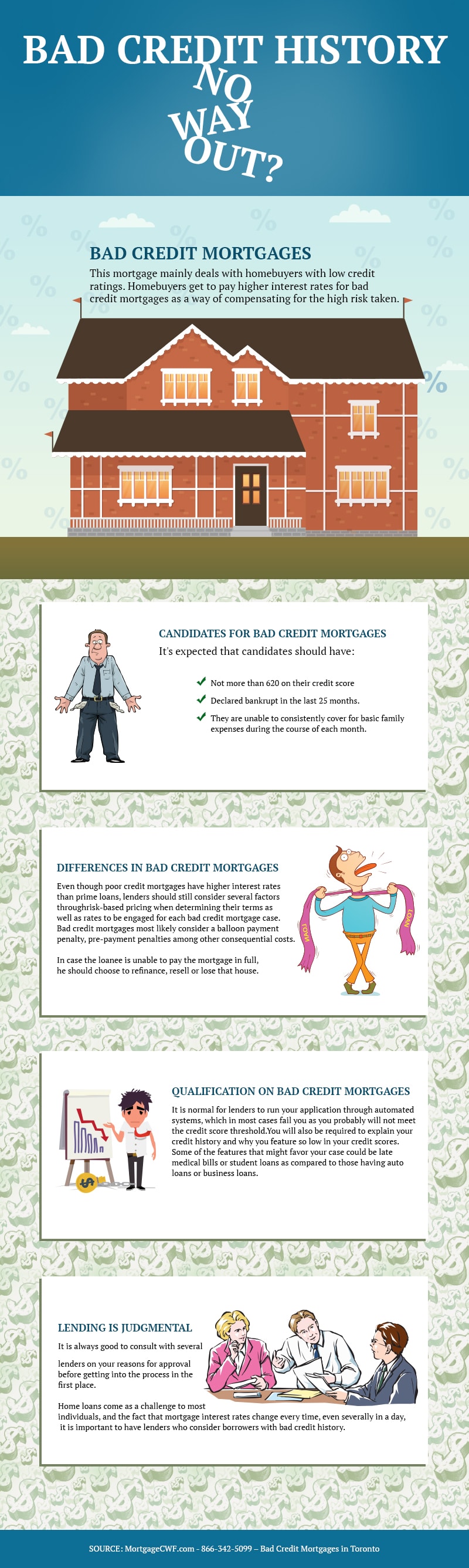

Bad Credit History. No way out?

Use the Code Below to Embed this Infographic into Your Website!

Bad Credit Mortgages

This mortgage mainly deals with homebuyers with low credit ratings. As a result, such individuals cannot access conventional mortgages as the lender dictates their circumstance as a larger-than-average risk that may not fully paying off the home loans. Nonetheless, homebuyers get to pay higher interest rates for bad credit mortgages as a way of compensating for the high risk taken.

Candidates for Bad Credit Mortgages

The general rule on these individuals follows a strict set of guidelines that vary with different lenders. However, we will try to capture the most relevant for poor credit mortgages. Its expected that candidates should have:

- Not more than 620 on their credit score

- At least two delinquencies for 30 days related to a mortgage in the last 12 months.

- One delinquency lasting 60 days related to a mortgage in the last 12 months.

- Faced foreclosure in the last 24 months.

- Declared bankrupt in the last 25 months.

- Their debt-to-income ratio is over 50 percent.

- They are unable to consistently cover for basic family expenses during the course of each month.

Differences in Bad Credit Mortgages

Even though poor credit mortgages have higher interest rates than prime loans, lenders should still consider several factors through risk-based pricing when determining their terms as well as rates to be engaged for each bad credit mortgage case. One of the factors to be considered should be the rating on the loanee’s credit score; the higher it is, the lower the interest rates will be. It should also consider the kinds of delinquencies recorded in the loanee’s credit report and the down payment as well. A good example is when the lender may view late rent or missed monthly payments worse than late credit card payments.

Bad credit mortgages most likely consider a balloon payment penalty, pre-payment penalties among other consequential costs. The pre-payment penalty is a fee placed against the borrower when he pays the home loan before its due. Normally, early payoffs have been related to the loanees selling the house or refinancing it. A mortgage with a balloon payment dictates that the loanee has to pay off the remaining balance in one sum after a specified period, commonly five years. In case the loanee is unable to pay the mortgage in full, he should choose to refinance, resell or lose that house.

Qualification on Bad Credit Mortgages

It is normal for lenders to run your application through automated systems, which in most cases fail you as you probably will not meet the credit score threshold. It is at this point that the lenders may decide to look at your case manually, and this may involve checking whether you have been late in paying your rent in the last 12 months or you have cash reserves that can go for six months in the bank. Therefore, for you to increase your chances of approval, it is important you keep up-to-date receipts on your rental payments or obtain a bank statement for the past six months. This challenge can also be solved by making a bigger down payment which should be at least 20 percent of the total sum of the mortgage. It will be pointless if you cannot meet any of these criteria and continue shopping for bad credit mortgages.

You will also be required to explain your credit history and why you feature so low in your credit scores. This can be done by stating that you are currently paying your rent plus other utility services that will not be incurred once you are awarded the poor credit mortgage. Otherwise, you may also argue on the basis of losing a job, death in your family, getting injured or getting a new job that pays much lower than what you used to have. Some of the features that might favor your case could be late medical bills or student loans as compared to those having auto loans or business loans.

Lending is Judgmental

Most lenders will bring potential borrowers onto a credit class just to explain to them the dangers of taking a bad credit mortgage as it could further lower their ability to borrow or disapprove them completely in the foreseeable future. The underwriters do not consider FHA guidelines as very key for individuals with low credit scores; rather, they focus more on common sense. It is, therefore, always good to consult with several lenders on your reasons for approval before getting into the process in the first place. That way, you will have a good foundation on how to argue your case from the beginning.

Home loans come as a challenge to most individuals, and the fact that mortgage interest rates change every time, even severally in a day, it is important to have lenders who consider borrowers with bad credit history.