Get Pre-Approved Now

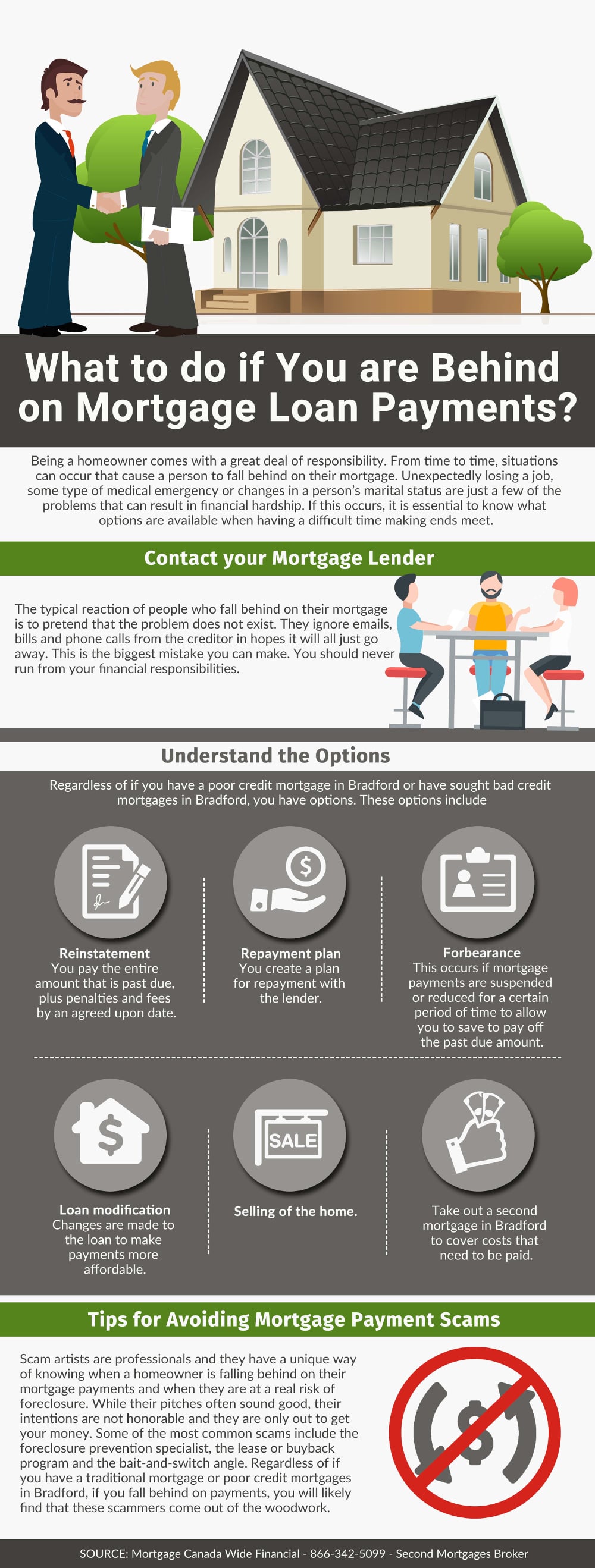

What to do if You are Behind on Mortgage Loan Payments?

Use the Code Below to Embed this Infographic into Your Website!

Being a homeowner comes with a great deal of responsibility. From time to time, situations can occur that cause a person to fall behind on their mortgage. Unexpectedly losing a job, some type of medical emergency or changes in a person’s marital status are just a few of the problems that can result in financial hardship. If this occurs, it is essential to know what options are available when having a difficult time making ends meet.

Contact your Mortgage Lender

The typical reaction of people who fall behind on their mortgage is to pretend that the problem does not exist. They ignore emails, bills and phone calls from the creditor in hopes it will all just go away. This is the biggest mistake you can make. You should never run from your financial responsibilities.

The first step in handling an outstanding debt is to acknowledge it. Contact the mortgage lender and let them know you are serious about getting caught up on the payments that are behind. There are several options available and mortgage lenders are often willing to provide loan modifications and repayment plans that are affordable. They can also provide a temporary reduction for the mortgage payment until your financial situation gets better.

Understand the Options

Regardless of if you have a poor credit mortgage in Bradford or have sought bad credit mortgages in Bradford, you have options. These options include:

- Reinstatement: You pay the entire amount that is past due, plus penalties and fees by an agreed upon date.

- Repayment plan: You create a plan for repayment with the lender.

- Forbearance: This occurs if mortgage payments are suspended or reduced for a certain period of time to allow you to save to pay off the past due amount.

- Loan modification: Changes are made to the loan to make payments more affordable.

- Selling of the home.

- Take out a second mortgage in Bradford to cover costs that need to be paid.

Tips for Avoiding Mortgage Payment Scams

Scam artists are professionals and they have a unique way of knowing when a homeowner is falling behind on their mortgage payments and when they are at a real risk of foreclosure. While their pitches often sound good, their intentions are not honorable and they are only out to get your money. Some of the most common scams include the foreclosure prevention specialist, the lease or buyback program and the bait-and-switch angle. Regardless of if you have a traditional mortgage or poor credit mortgages in Bradford, if you fall behind on payments, you will likely find that these scammers come out of the woodwork. Being aware of their presence will help you avoid falling for their pitch.

There is absolutely no question that falling behind on your mortgage payments can be a stressful and overwhelming experience. However, doing nothing is only going to lead to more issues and financial hardship down the road. The tips here will help you find the best course of action for your default mortgage payment issue.