Get Pre-Approved Now

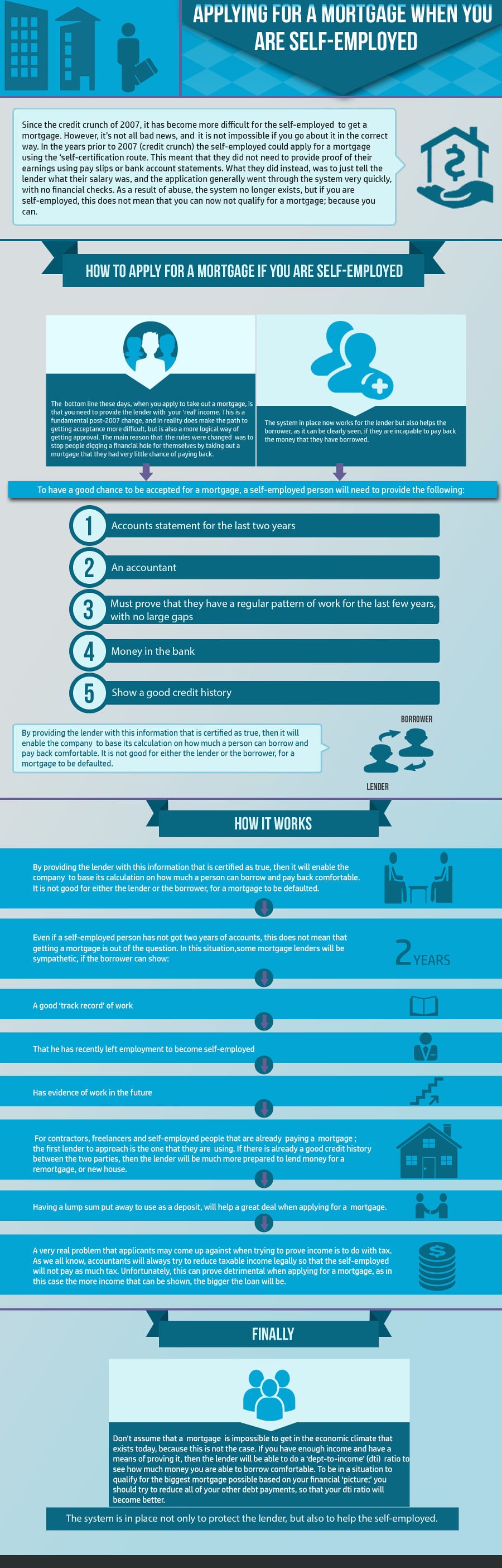

Applying For A Mortgage When You Are Self-Employed

In case you are self-employed, applying for a mortgage can be quite confusing. In order to be able to qualify for a mortgage loan self-employed individuals will need to provide a lot of documents to the lender to verify their self-employment. In the following infographic we will guide you through the steps of applying for a mortgage and help you qualify for the loan you deserve.

Use the Code Below to Embed this Infographic into Your Website!

How to apply for a mortgage if you are self-employed

Since the credit crunch of 2007, it has become more difficult for the self-employed to get a mortgage. However, it’s not all bad news, and it is not impossible if you go about it in the correct way. In the years prior to 2007 (credit crunch) the self-employed could apply for a mortgage using the ‘self-certification route. This meant that they did not need to provide proof of their earnings using pay slips or bank account statements. What they did instead, was to just tell the lender what their salary was, and the application generally went through the system very quickly, with no financial checks. As a result of abuse, the system no longer exists, but if you are self-employed, this does not mean that you can now not qualify for a mortgage; because you can.

The bottom line these days, when you apply to take out a mortgage, is that you need to provide the lender with your ‘real’ income. This is a fundamental post-2007 change, and in reality does make the path to getting acceptance more difficult, but is also a more logical way of getting approval. The main reason that the rules were changed was to stop people digging a financial hole for themselves by taking out a mortgage that they had very little chance of paying back.

The system in place now works for the lender but also helps the borrower, as it can be clearly seen, if they are incapable to pay back the money that they have borrowed.

To have a good chance to be accepted for a mortgage, a self-employed person will need to provide the following:

- Accounts statement for the last two years

- An accountant

- Must prove that they have a regular pattern of work for the last few years, with no large gaps

- Money in the bank

- Show a good credit history

By providing the lender with this information that is certified as true, then it will enable the company to base its calculation on how much a person can borrow and pay back comfortable. It is not good for either the lender or the borrower, for a mortgage to be defaulted.

How it works

Most lenders will insist that an applicant has an accountant, who has helped prepare the accounts. It is vital that the accounts, are up to date as the application will not run as smoothly if the figures presented to the lender are not current.

Even if a self-employed person has not got two years of accounts, this does not mean that getting a mortgage is out of the question. In this situation,some mortgage lenders will be sympathetic, if the borrower can show:

- a good ‘track record’ of work

- that he has recently left employment to become self-employed

- has evidence of work in the future

For contractors, freelancers and self-employed people that are already paying a mortgage; the first lender to approach is the one that they are using. If there is already a good credit history between the two parties, then the lender will be much more prepared to lend money for a remortgage, or new house.

Having a lump sum put away to use as a deposit, will help a great deal when applying for a mortgage.

A very real problem that applicants may come up against when trying to prove income is to do with tax. As we all know, accountants will always try to reduce taxable income legally so that the self-employed will not pay as much tax. Unfortunately, this can prove detrimental when applying for a mortgage, as in this case the more income that can be shown, the bigger the loan will be.

Finally

Don’t assume that a mortgage is impossible to get in the economic climate that exists today, because this is not the case. If you have enough income and have a means of proving it, then the lender will be able to do a ‘dept-to-income’ (dti) ratio to see how much money you are able to borrow comfortable. To be in a situation to qualify for the biggest mortgage possible based on your financial ‘picture;’ you should try to reduce all of your other debt payments, so that your dti ratio will become better.

The system is in place not only to protect the lender, but also to help the self-employed. Please, browse our site to find out more about mortgage loan solutions for self-employed individuals.