Get Pre-Approved Now

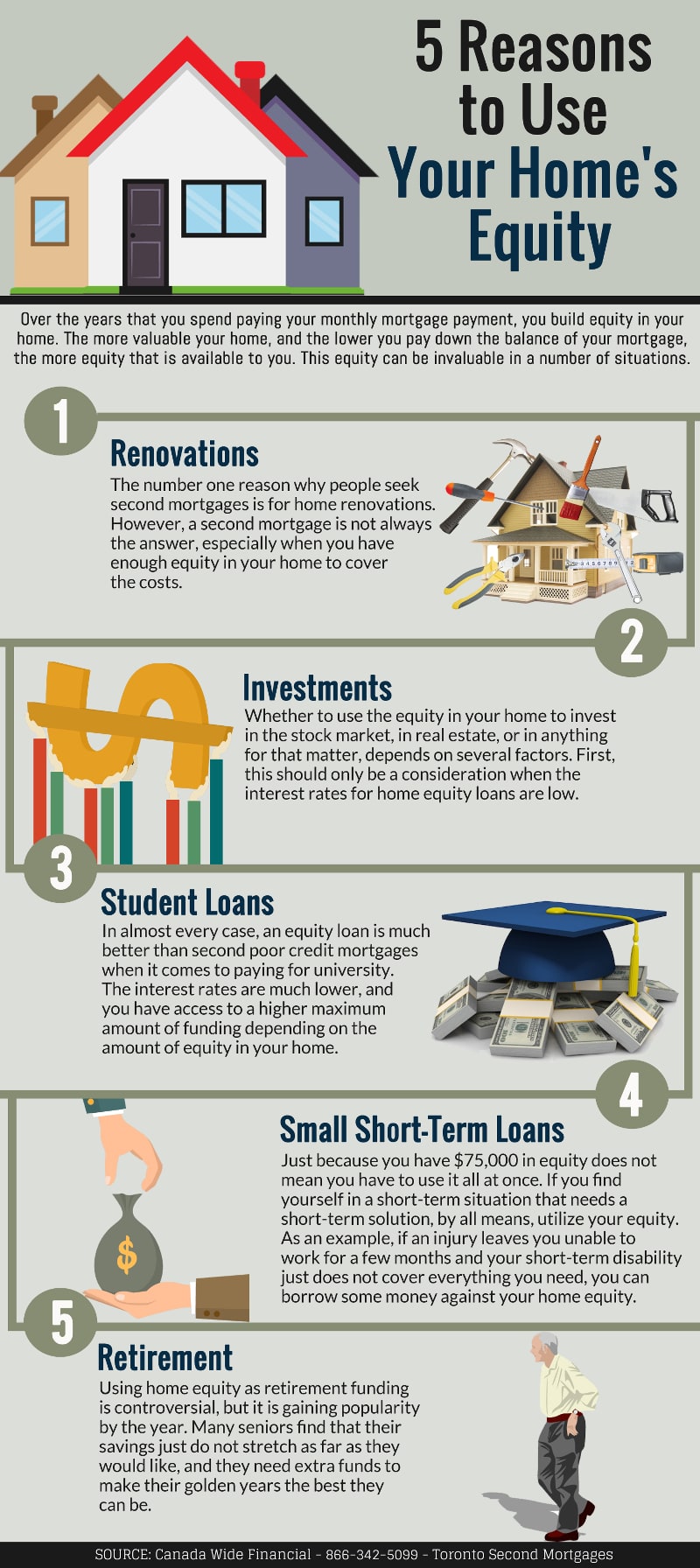

5 Reasons to Use Your Home's Equity

Use the Code Below to Embed this Infographic into Your Website!

Over the years that you spend paying your monthly mortgage payment, you build equity in your home. The more valuable your home, and the lower you pay down the balance of your mortgage, the more equity that is available to you. This equity can be invaluable in a number of situations. Here are five sound reasons to use your homes equity rather than take out a second mortgage in Oshawa.

#1 – Renovations

The number one reason why people seek second mortgages is for home renovations. However, a second mortgage is not always the answer, especially when you have enough equity in your home to cover the costs. Not only can you leverage your equity to make your home more attractive and comfortable, but renovation also adds market value, which improves your equity at the same time.

#2 – Investments

Whether to use the equity in your home to invest in the stock market, in real estate, or in anything for that matter, depends on several factors. First, this should only be a consideration when the interest rates for home equity loans are low. For example, if you can cash in on your equity for 3% interest, invest those funds, and yield 10%, then you made a 7% profit. Second, whether to invest also depends on your financial security and your overall investment knowledge.

#3 – Student Loans

In almost every case, an equity loan is much better than second poor credit mortgages when it comes to paying for university. The interest rates are much lower, and you have access to a higher maximum amount of funding depending on the amount of equity in your home. Just make sure that you understand the repercussions; home equity loans essentially extend the length of your mortgage, and you might find that you need to delay retirement for a few years to repay them.

#4 – Small Short-Term Loans

Just because you have $75,000 in equity does not mean you have to use it all at once. If you find yourself in a short-term situation that needs a short-term solution, by all means, utilize your equity. As an example, if an injury leaves you unable to work for a few months and your short-term disability just does not cover everything you need, you can borrow some money against your home equity. A second mortgage is not always necessary, and borrowing against your own equity is much better than accumulating credit card debt.

#5 – Retirement

Using home equity as retirement funding is controversial, but it is gaining popularity by the year. Many seniors find that their savings just do not stretch as far as they would like, and they need extra funds to make their golden years the best they can be. A reverse mortgage is a very appealing option to many people, and it is a much better option than second mortgages for retirement expenses. In short, a lender provides you with a lump sum or a monthly stream of income based on the equity in your home. Then, following your death or your movement from the home, the lender possesses and resells the home.

You can utilize your home equity responsibly for a number of different purposes. Renovations are the most popular because they pay for themselves with added equity, but whether you need a short-term emergency loan or you want to put your child through college, that equity is a better (and less expensive) option than a second poor credit mortgage.