Get Pre-Approved Now

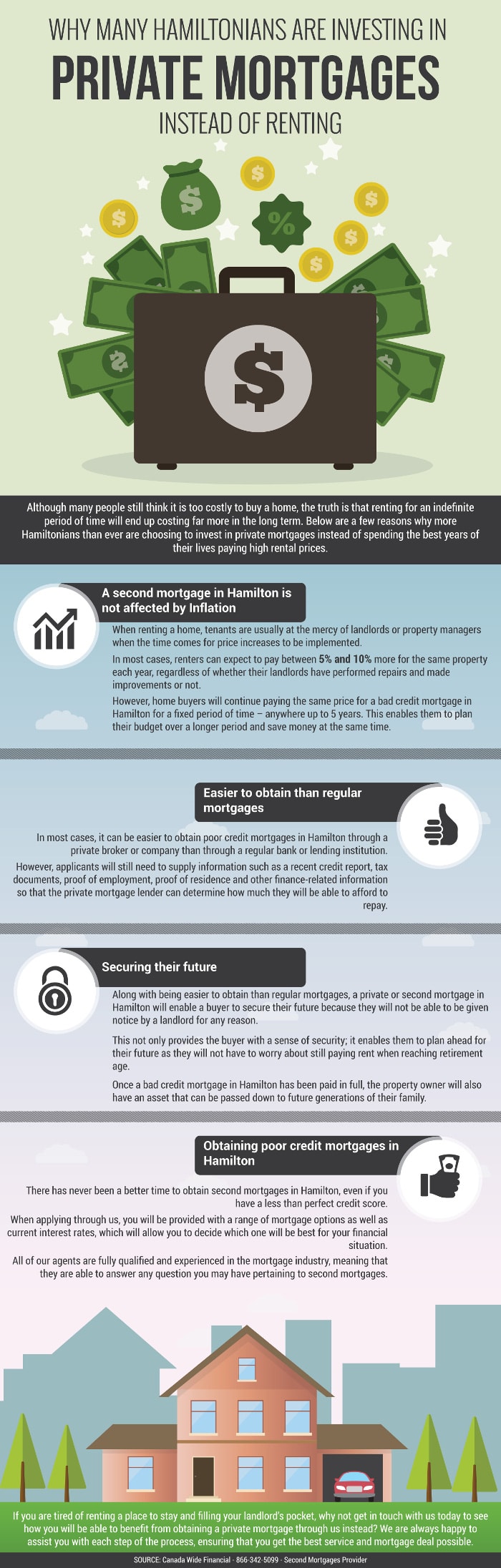

Why Many Hamiltonians Are Investing in Private Mortgages Instead of Renting

Use the Code Below to Embed this Infographic into Your Website!

Although many people still think it is too costly to buy a home, the truth is that renting for an indefinite period of time will end up costing far more in the long term. Below are a few reasons why more Hamiltonians than ever are choosing to invest in private mortgages instead of spending the best years of their lives paying high rental prices.

#1 - A second mortgage in Hamilton is not affected by Inflation

When renting a home, tenants are usually at the mercy of landlords or property managers when the time comes for price increases to be implemented. In most cases, renters can expect to pay between 5% and 10% more for the same property each year, regardless of whether their landlords have performed repairs and made improvements or not. However, home buyers will continue paying the same price for a bad credit mortgage in Hamilton for a fixed period of time – anywhere up to 5 years. This enables them to plan their budget over a longer period and save money at the same time.

#2 - Easier to obtain than regular mortgages

In most cases, it can be easier to obtain poor credit mortgages in Hamilton through a private broker or company than through a regular bank or lending institution. However, applicants will still need to supply information such as a recent credit report, tax documents, proof of employment, proof of residence and other finance-related information so that the private mortgage lender can determine how much they will be able to afford to repay.

#3 - Securing their future

Along with being easier to obtain than regular mortgages, a private or second mortgage in Hamilton will enable a buyer to secure their future because they will not be able to be given notice by a landlord for any reason. This not only provides the buyer with a sense of security; it enables them to plan ahead for their future as they will not have to worry about still paying rent when reaching retirement age. Once a bad credit mortgage in Hamilton has been paid in full, the property owner will also have an asset that can be passed down to future generations of their family.

#4 - Obtaining poor credit mortgages in Hamilton

There has never been a better time to obtain second mortgages in Hamilton, even if you have a less than perfect credit score. When applying through us, you will be provided with a range of mortgage options as well as current interest rates, which will allow you to decide which one will be best for your financial situation. All of our agents are fully qualified and experienced in the mortgage industry, meaning that they are able to answer any question you may have pertaining to second mortgages.

If you are tired of renting a place to stay and filling your landlord’s pocket, why not get in touch with us today to see how you will be able to benefit from obtaining a private mortgage through us instead? We are always happy to assist you with each step of the process, ensuring that you get the best service and mortgage deal possible.